Business Advisory

Business Advisory Services

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Designed for rental property owners where WCG CPAs & Advisors supports you as your real estate CPA.

Everything you need from tax return preparation for your small business to your rental to your corporation is here.

Fermentum aliquet amet

tristique purus vitae. Adipiscing

id rhoncus quisque mauris amet.

Posted Wednesday, December 4, 2024

Table Of Contents

The holidays are coming and people start thinking about year-end moves to minimize their taxes. Every day between Christmas and New Year’s Day we field a zillion questions on year-end tax planning. While some ideas are great, there are pitfalls and sucker-holes. We’ll talk about tax deductions in general. We’ll talk about last-minute tax moves. And Yes, we’ll talk about automobiles. They always seem to top the list of good ideas (or at least most business owners think so).

The holidays are coming and people start thinking about year-end moves to minimize their taxes. Every day between Christmas and New Year’s Day we field a zillion questions on year-end tax planning. While some ideas are great, there are pitfalls and sucker-holes. We’ll talk about tax deductions in general. We’ll talk about last-minute tax moves. And Yes, we’ll talk about automobiles. They always seem to top the list of good ideas (or at least most business owners think so).

Also, we have a separate Tax Reduction article that is more aimed at general tax reduction strategies and not necessarily year-end tax moves. However, there is a lot of overlap.

There are two big objectives with end-of-year tax planning-

Please don’t forget the “make plans for 2025” part since big changes in business income or other events in your life need to be addressed early, and perhaps before April 15, 2025 for Q1’s estimated tax payment. As such we will talk about this first.

If your business income is going to be higher in 2025 than 2024, then we should get a jump on your business tax planning with these considerations. Remember, there is no such thing as an accounting emergency; only poor planning.

California is an easy target, but there are several other states which impose a franchise tax or some sort of “pleasure to do business in our state” tax. Additionally, these taxes are similar to income taxes where they must be paid quarterly in advance otherwise underpayment penalties and interest might be incurred.

PTET in a nutshell is the ability to pay your “human” state income taxes with business funds and thereby create a tax deduction for the business and eventually you as the owner. We discuss this in greater detail later. For now, there are two possible PTET dangers here so please pay attention- first, if 2025 is the first year of your pass-through entity such as an S corporation or partnership, and you want to participate in your state’s PTET program, then business tax planning is a must. Payments must be made on time (April, June, September, December) and in some cases, a timely registration and election must be made.

PTET in a nutshell is the ability to pay your “human” state income taxes with business funds and thereby create a tax deduction for the business and eventually you as the owner. We discuss this in greater detail later. For now, there are two possible PTET dangers here so please pay attention- first, if 2025 is the first year of your pass-through entity such as an S corporation or partnership, and you want to participate in your state’s PTET program, then business tax planning is a must. Payments must be made on time (April, June, September, December) and in some cases, a timely registration and election must be made.

Second, if 2025 is going to be more profitable than 2024, then your PTET payments need to be increased to prevent underpayment penalties and interest. For example, you converted from W-2 to 1099 contractor in the summer of 2024, and 2025 is going to be the first full-year with your new contractor status, a business tax plan needs to be updated to account for your increased 2025 PTET payments (and likely your franchise tax or business tax imposed by the state).

If your business profit will jump up in 2025 as compared to 2024, then we must adjust your reasonable salary to accommodate for this change. More importantly, we must adjust your federal and state income tax withholdings. If we wait until tax planning season (May, June, July), two bad things happen- first, you get used to this new cash flow and start spending it, and second, the compression of waiting too long makes catching up painful.

Sooner than later is the motto.

January is a great time to update your 2025 business tax plan, but only if there is a material difference between 2024 and 2025. If you call up and say, “hey, my business is going to be up 5%, can I get an updated business tax plan?” We will say “Yes, absolutely… but let’s wait until summer.” January business tax planning is very compressed, and therefore we kindly want to reserve it for those who truly need it.

Otherwise, if you are curious about your Q1 or Q2 franchise or business tax, or your PTET payment, please use 2024 as a proxy for 2025 until we can tweak with an updated business tax plan in the summer.

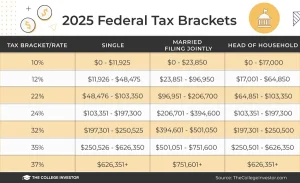

Here is a comparison table for your perusal-

| 2024 | 2025 | |

| IRA | 7,000 | 7,000 |

| Roth IRA Income Limits | 146,000 single | 150,000 single |

| 230,000 married | 236,000 married | |

| 401k Employee | 23,000 | 23,500 |

| HSA Contribution | 4,150 self | 4,300 self |

| 8,300 family | 8,550 family | |

| Social Security Wage Limit | 168,600 | 176,100 |

| Standard Deduction | 14,600 single | 15,000 single |

| 29,200 married | 30,000 single | |

| Gift Limit | 18,000 | 19,000 |

| Foreign Income Exclusion | 126,500 | 130,000 |

| Mileage Deduction | 67 cents | Update in Dec |

Contrary to popular belief, there is no secret tax deduction club that only a few of us know about, and even fewer talk about. This isn’t fight club, OK? Thanks to all the internets, the speed and volume of data simply puts all ideas and thoughts on the forefront. Are there little tricks that some accountants aren’t aware of? Sure. Do accountants routinely inject their level of risk aversion into your decision-making? Yes. At WCG CPAs & Advisors we will ensure ethical guidelines are met and clear tax positions are followed. But please do not call us and let us know that your neighbor… the one with two homes and a yacht… does not pay taxes. Stop believing everything heard at a cocktail party or from your produce clerk.

Having completed our rant, we swim in the grey waters with slivers of white and black. We will provide you with options, arguments and counter-arguments. Ultimately it is your life and your tax return, and as facilitators in the tax return preparation process, we will offer guidance as you walk through it.

Two households, making the exact same income, might have wildly different tax liabilities based on the myriad of variables such as children, mortgage interest, charitable donations, available tax credits, and, Yes, the proficiency of the tax professionals involved.

As household incomes travel through the ranges, a lot of things happen. The first $100,000 in income for most households is well-sheltered with itemized deductions and low tax brackets. The next $100,000 in income sees certain tax credits go away, higher tax brackets and fewer available tax deductions such as IRAs and other things (what we call income phase-outs). In other words, if you go from $100,000 to $200,000 in household income, you will pay way more than double in taxes (you could easily see 2.5 to 3.0 times more). Yuck! The next $100,000 and beyond is completely naked, and is generally purely taxable (unless some tax reduction tactics are deployed). Super yuck!

Quick lesson on tax deductions. When you write a check and it has a tax savings element (401k, IRA, charity, etc.) it is not a dollar-for-dollar savings. For example, if you are in the 22% marginal tax bracket, you must write a check for $4,000 just to save $880 in taxes. Keep this in mind as you read this information on year-end tax savings. Also keep in mind that cash is king, and that perhaps paying a few more taxes today with the added flexibility of cash in the bank can be comforting.

Quick lesson on tax deductions. When you write a check and it has a tax savings element (401k, IRA, charity, etc.) it is not a dollar-for-dollar savings. For example, if you are in the 22% marginal tax bracket, you must write a check for $4,000 just to save $880 in taxes. Keep this in mind as you read this information on year-end tax savings. Also keep in mind that cash is king, and that perhaps paying a few more taxes today with the added flexibility of cash in the bank can be comforting.

Another way to look at it is this- most people say “I want to save taxes” but really what they are saying is “I want to save cash.” In other words, most people are in the cash-saving business not the tax-saving business. If we can do both, great. However, most tax-savings moves take cash, and cash is what you want to keep. So, keep this concept in mind as review some of the year-end tax moves listed below.

Also!

Tax deductions and tax deferrals are not the same. Tax deferrals are tax bombs later in life; little IOU’s to the IRS and they will eventually call in the chit. But if you use the immediate tax savings to build wealth, then a tax deferral is worth it. Deferring taxes to pay for a cruise vacation might not always be the best approach (then again, live a little!).

Wait, there’s more!

Just because you go $1 into the next tax bracket does not mean all your dollars are taxed at that rate. So, if you are trying to thread the needle with a Roth conversion to not fly too close to the sun out of fear of blowing up your tax world, don’t sweat it too much. Sure, if you push $25,000 into the 32% marginal tax bracket when you could have delayed until next year, that is an 8% x $25,000 or a $2,000 mistake. Sidebar- the 8% is 32% less 24%.

At the end of your life, you’ll measure your financial success on the wealth you built not the tax you saved. We agree that a part of wealth building includes tax savings, but be careful not to sacrifice wealth for the thrill of a tax deduction (or deferral). Here is an example- let’s say you stuff all your available cash into a tax-advantaged retirement account such a 401k. A few years go by and a great rental property comes on the market but your cash is all tied up in a 401k. So, you sacrificed potential building of wealth by not having an intermediate investment strategy for the sake of tax deferrals.

Don’t let the tax tail wag the wealth dog!

We discuss this concept throughout this article, but we want to make it front and center early. Ideally, you want to align your deductions with your income, or your income with your deductions. What are we talking about?

You had a bang-up year. You just crushed it, and a big bonus is coming your way. Your company asks you if you want to be paid in December or January. Why do you care? If you push this bonus in 2025, it might be taxed at a lower tax rate if your business or work productivity returns to a normal orbit. Don’t confuse bonus withholdings versus tax- many companies will over-withhold on bonuses intentionally, but that doesn’t mean you are taxed differently.

You had a bang-up year just like the example above. Do you perform that cost segregation study on your short-term rental property this year, or next? It depends, right? If 2025 is going to have more taxable income than 2024, then perhaps you wait. Alternatively, if you have plans to add more rentals in 2025 because interest rates are decreasing and the real estate market is loosening up a bit, then perhaps 2025 is protected with these new rentals and a cost segregation study applied to 2024 makes sense.

2024 was a good year, but 2025 is going to be much better. It could be that your business is taking off or you will have a full-year of being in business, or something to push your marginal tax rate up in 2025. In this example, and in the interest of aligning income and deductions, wait until 2025 for that big purchase or tax move.

The net-net to all this year-end tax planning is to consider this year compared to next, exercise some restraint and align your tax deductions with your income.

Here’s the trick. The Holy Grail if you will. You need to find a way to deduct money you are already spending. Read that again. For example, if you have a travel budget then you are already comfortable with a certain amount of money leaving your person, let’s find a way to deduct it. Automobile depreciation? Same thing. You are already comfortable with automobiles losing thousands of dollars in value especially in the early years; so let’s find a way to make this degradation in value a tax windfall.

The left button above is labeled Tax Deductions and Fringe Benefits which is an excerpt of Chapter 11 from our S Corp book. The next button is from our latest book, I Just Got a Rental, What Do I Do? The CRNA button is for our growing group of Certified Registered Nurse Anesthetists. These examples are more aimed at small business owners, but there might be some things you can do on your individual tax return. Remember that the greatest trick the devil ever pulled was convincing the world he didn’t exist. The second greatest trick was finding a way to deduct the expense. You gotta love The Usual Suspects. Classic!

The deduction for what you pay in state and local income, sales and property taxes is also getting squeezed. This is commonly referred to as SALT deductions (State And Local Tax). People commonly say SALT deductions and property taxes. Property taxes are inclusive of state and local tax… it is like saying drugs and alcohol. Alcohol is a drug. SALT deductions include all taxes imposed by your state or local jurisdiction. This was defined as such by the Revenue Act of 1913 and later clarified in 1964. Riveting. But somehow we’ve managed to say SALT deductions and property taxes as separate items. At least it is not as bad as saying ATM Machine or ABS Brakes. Who says that? We digress…

The Tax Cuts and Jobs Act of 2017, back when Despacito was the big hit, limited the amount of SALT deductions on Schedule A of your Form 1040 (individual tax return) to $10,000. Therefore, if you have property taxes of $6,000 and California income tax of $6,000, you are only able to deduct $10,000 of this $12,000. This leaves $2,000 on the table, or about $500 if you are in the 24% marginal tax bracket.

The Tax Cuts and Jobs Act of 2017, back when Despacito was the big hit, limited the amount of SALT deductions on Schedule A of your Form 1040 (individual tax return) to $10,000. Therefore, if you have property taxes of $6,000 and California income tax of $6,000, you are only able to deduct $10,000 of this $12,000. This leaves $2,000 on the table, or about $500 if you are in the 24% marginal tax bracket.

Crank this up a bit. How about $12,000 in property taxes and $12,000 in California income taxes? You are short-changed by about $3,400 in cash unless…

There is a work-around for business owners of S Corporations and Partnerships, or what we call pass-through entities or PTEs. About 37 states are allowing business owners to make a tax payment to the state based on net business income. This does two things- first, it reduces the amount of business income subject to federal income tax (your ultimate tax deduction). Second, the state provides a credit for this amount and reduces your state income tax calculation on your Form 1040 (some states don’t provide a direct tax credit, but rather decrease your taxable income by the amount of business profits… Georgia does this, for example, and you arrive at the same spot as a tax credit).

The IRS took note of the workaround, but understood it was perfectly legit. The IRS through Notice 2020-75 states,

Certain jurisdictions described in section 164(b)(2) have enacted, or are contemplating the enactment of, tax laws that impose either a mandatory or elective entity-level income tax on partnerships and S corporations that do business in the jurisdiction or have income derived from or connected with sources within the jurisdiction. In certain instances, the jurisdiction’s tax law provides a corresponding or offsetting, owner-level tax benefit, such as a full or partial credit, deduction, or exclusion.

The IRS continues by stating this practice is permitted under the notice until it can legislate this practice into regulations. Also, there are all kinds of rules, and not every business owner will benefit from making a pass-through entity tax election. As such, the tax planning for determining the efficacy of using this tax deduction is challenging.

Wow. That was a lot of gibberish, huh? Talk to your favorite tax pro at WCG CPAs & Advisors, and make sure you understand this amazing workaround for tax deductions being truncated by SALT limits. The cocktail party fodder term is “PTET election” or “SALT workaround,” where PTET stands for pass-through entity tax. There are some devils in the details, and not all states work the same. Yes, we are as surprised as you are.

The basics are this: Using Colorado as an example, you pay 4.55% of your estimated 2022 net business income to Colorado, and Colorado effectively reduces your tax due by this amount (and this amount reduces your federal income tax). Quick math: 4.55% x $200,000 in business income equals $9,100, and at 24% marginal tax rate puts $2,184 into your pocket if you are SALT limited.

All this nonsense likely sunsets in 2025 unless Congress can extend, so 2026 tax returns due in 2027 might not have this problem. It’s just around the corner everyone! The button below will take you to our Pass-Through Entity Tax (PTET) Deduction article that we posted in early summer of 2022.

Learn to maximize tax savings using deductions and IRS guidance for your business taxes.

Let’s talk about the Hummer Loophole, as they say. At some point, long ago, in a galaxy far far away, businesses could buy heavy trucks such as pickup trucks and Hummers and deduct them 100%. Was this a loophole of sorts? Yes. Does Congress and the IRS like loopholes? No, not really, unless it benefits them.

Then along comes 2017 and a bunch of tax incentives, and this tax deduction does a U-turn. However, 2022 was the last year of 100% bonus depreciation. It is now 60% in 2024 and keeps on trucking, more intended puns, to 40% in 2025, and 0% by 2027.

The problem for 2024 is that a lot of people forgot about the class favorite which is Section 179 depreciation (since we had 100% bonus depreciation for so many years). Since bonus is only 60%, Section 179 is looking sexy again.

How does this work?

You should deduct as much as possible using Section 179 depreciation (expensing) and then apply 60% bonus depreciation to the remainder. For example, let’s say you buy a heavy vehicle for $80,000 in 2024 and it’s 100% business use.

You can deduct the first $30,500 of the cost in 2024 under Section 179. Next, you can also deduct a first-year bonus depreciation deduction in 2024 equal to 60% of the remaining cost of $49,500 ($80,000 minus $30,500). As such your total accelerated depreciation deduction for the business vehicle would be $60,200 ($30,500 plus $29,700). This is a nice dent to your taxable income. Ok, we’ll stop with the puns.

The problem remains with luxury passenger vehicles weighing under 6,000 pounds. Those limits are $20,400 for the first year using bonus depreciation, or $12,400 if you elect out. Some luxury passenger vehicles weigh over 6,000 pounds and therefore are considered heavy vehicles. For example, the new 2025 Porsche Cayenne has a gross vehicle weight rating of 6,239 to 6,470 pounds, and is totally sexy.

Having said all this, buy a business vehicle because it makes operational sense (or at least has a purpose). We don’t buy vehicles solely for the tax deduction benefit. You are still parting with cash. Cash is king.

We cannot stress this enough! Another consideration is your income in 2024 versus 2025. If you are going to have a better year in 2025, then delay your tax deduction until January 1. Why pile on tax deductions in a low-income year? Silly. Conversely, if 2024 is unusually high, then Yes, pile on those tax deductions. Either way, have a plan! Don’t be shortsighted. Don’t save taxes just because you can- make sure it is the right move over your lifetime and not just today.

Some taxpayers have their refunds kept by the IRS because of back taxes, or other obligations such as student loans. In these situations, you can put yourself in a “tax due” position by decreasing your withholdings on your pay checks and putting more money in your pocket today. Yes, you will still owe whatever it is you owe, but at least the extra cash you pay in the form of excess income taxes withheld won’t be used to accelerate your debt payoff.

Some taxpayers have their refunds kept by the IRS because of back taxes, or other obligations such as student loans. In these situations, you can put yourself in a “tax due” position by decreasing your withholdings on your pay checks and putting more money in your pocket today. Yes, you will still owe whatever it is you owe, but at least the extra cash you pay in the form of excess income taxes withheld won’t be used to accelerate your debt payoff.

The simplest way to save taxes… err, defer taxes… is to contribute to your 401k plan or traditional IRA. You save taxes and pay yourself in the meantime. Remember this as well- this is an IOU to the IRS. When you retire and are forced to withdraw this money, you will be taxed on it. IRA and Roth IRA contributions are due Tuesday, April 15, 2025 (the typical filing deadline for individual tax returns Form 1040), no exceptions. SEP IRAs remain the same, but can also be extended to September 15 or October 15, depending on which tax return you extended (1065/1120S – Sep 15, 1040/1120 – Oct 15).

SEP IRAs are old school. Lousy contribution limits. No Roth options. A 401k plan is much better. Ask how we can help.

Perhaps you should have us review the conversion of your traditional IRA into a Roth IRA. Yes, pay more taxes today, but perhaps your 2024 income is lower and it makes sense. Or your income is on a rocket trajectory, and this year is the only year it makes sense. Remember that it is usually easier to pay for taxes during your wage-earning years than when you are 80 years old and only have savings to “dip into.” It would be lovely to live in a tax-free world at 80… at least for federal income taxes.

2025 limit for your 401k is $23,500 + $7,500 for catch-up, hold the mayo. Max total 401k is $70,000 ($23,500 employee + $46,500 employer). IRAs are $7,000 plus $1,000 catch-up.

Writing a check to your church is good. Don’t forget the theater, educational organizations, and others. Also, what is not just good, but actually great, is donating to Goodwill, Salvation Army, Arc Thrift, etc. Donating items from the hollows of your closet doesn’t require cash since that money is already spent. Keep in mind that some states, such as Arizona, offer huge tax credits (much better than tax deductions) for donations to schools and charities.

Don’t forget a qualified charitable distribution. A QCD is a direct transfer of funds from your IRA to a qualified charity. QCDs can be counted toward satisfying your required minimum distributions (RMDs) for the year, as long as certain rules are met.

You donate significant assets such as cash or securities or both to a donor advised fund. You get an immediate tax deduction for the fair market value, but those assets are not immediately donated to any one charity. This allows for two wonderful things: first, playing on the income-deduction matching principle mentioned earlier, you can make a massive donation during a uniquely high-income year.

Second, you can then take your tax-deducted donation, and spread it out over multiple years while enjoying the tax benefit now.

Here is another consideration involving math: let’s say your itemized deductions add up to $17,000 yet the standard deduction is $29,200 (for the 2024 tax year)… or a difference of $12,000. You could donate $12,000 each year with no additional tax benefit (Yes, the state might give some) since you would be using the standard deduction versus an itemized deduction ($29,200 vs. $17,000) on Schedule A. Do this for 10 years… and your $120,000 does not move the tax needle at all. Zippo. Nadda.

But! You donate $120,000 to a donor advised fund (DAF), you get $108,000 at your marginal tax rate as cash in pocket ($104,000 x 24% is $25,920 in cash). You still get the itemized deduction bump of $12,000 to arrive at the standard deduction for 9 more years, your charity gets $12,000 each year as desired, and you are $25,920 richer. Real money, folks!

This is an oldie but a goodie. Speaking of liking cash: sell some of your profitable stocks along with your dogs. Not literally your dogs, but your under-performing securities. Sell enough to create a $3,000 gain and sell some more to add a $6,000 loss, and presto! You’ve pulled out some cash, yay, and created a $3,000 loss and tax deduction.

This is an oldie but a goodie. Speaking of liking cash: sell some of your profitable stocks along with your dogs. Not literally your dogs, but your under-performing securities. Sell enough to create a $3,000 gain and sell some more to add a $6,000 loss, and presto! You’ve pulled out some cash, yay, and created a $3,000 loss and tax deduction.

Here is another variant to the above year-end tax move: you sell securities whose price is stable yet is lower than what you paid. You use these losses to reduce the capital gains on securities you sold previously (profit harvesting). You wait 30 days to prevent wash sale triggers and re-purchase the securities that were sold at a loss (only if you believe it will eventually rebound in a timeframe that makes sense given inflation and other economic conditions).

Given market conditions now, this is a strong year-end strategy. There is another trick where you borrow against your unrealized gains. It is not necessarily a year-end tax move, however.

You can pre-pay certain expenses up to 12 months such as rent, insurance premiums, professional fees, stock up on some office supplies, etc. The “12-month rule” lets you deduct a prepaid future expense in the current year (but there are some rules). You want to pre-pay business expenses in years of high income where the following year is going to be less. To pre-pay just to pre-pay without a plan is flailing.

Our Reducing Taxes webpage as more information.

Here we are on everyone’s favorite topic. Buckle up… A question we entertain almost daily is “I want to save taxes. Should I have the company buy me a car?” Our auto-attendant replies with, “Do you need a car?” If you answer with “Yes” the auto-attendant replies with, “Hold please.” If your “Yes” is not quick or mumbled, or if there is any recognition of hesitation, the auto-attendant is unhappy and will send you to our call center in Hawaii.

We digress. There are only a few questions you need to ask yourself when considering a car purchase. Are you the type of person who buys new? How long do you typically keep your cars? Is the car 100% business use? How many miles do you plan to drive? There is a decision tree you can review on our website (see below). Back up for a bit. Remember our previous discussions about tax deductions, and how only a fraction of the money you spend is returned to you? So, back to our auto-attendant, “Do you need a car?” If the answer is “Yes” because your bucket of bolts is getting exceedingly dangerous, then Yes, buy a much-needed car out of a sense of safety. If the answer is “Not really, but I want to save taxes,” then don’t. Two rules to live by-

There might be some other external forces at play. For example, if you need a car next year but your income is ridiculously and unusually high in the current tax year, then reducing your income now makes sense. Again, tax modeling and planning is critical.

We leave room for the “I just wanna new car for no real reason since needs and wants occupy the same space in my brain.” Live life. Not everything has to make financial sense or be argued in a spreadsheet. Here is some more information-

Please understand that depreciation is a tax deferral system rather than a tax avoidance system. Huh? When you sell or dispose of an asset, you might have to pay tax on the portion that was depreciated.

For example, you buy a $200,000 piece of machinery and use Section 179 depreciation to deduct the entire $200,000 in the first year. Five years later you sell the equipment for $150,000 because you slapped some new paint on it and you are a shrewd negotiator with your buyer. You will now have to recognize $150,000 of taxable ordinary income. Yuck. But there is a silver lining- depreciation recapture is taxed at your marginal tax rate. So, if are going to have a low income year and you were planning on selling the machinery anyway, you could have depreciated your asset during 37% marginal tax rate years just to pay it all back at a much lower rate. Bonus! Tax planning is a must. How many times have we mentioned that?

For investment and rental property owners, there is an added bonus to depreciation recapture. It is capped at 25% regardless of your marginal tax rate. You can also kick this depreciation recapture can down the road with a Section 1031 exchange (also referred to as a like-kind exchange). Perform your favorite internet search on this topic- way too involved to explain here except that a Section 1031 exchange in most situations allows the deferral of depreciation recapture and capital gains by purchasing another investment property. And if you think you know what a 1031 like-kind exchange is, try learning about a reverse 1031 exchange- where you buy the replacement property first. Yup. It exists.

This one gets a little tricky. Let’s say you are a commercial real estate agent, and you sell a lease and collect a $10,000 commission. But there are provisions that if the tenant breaks the lease within three years, you have to pay some of the $10,000 back. Accountants would call this “Unearned Revenue” and we can kick this revenue into the subsequent years. So if you collect money today and there is a bona fide chance you might lose it, then perhaps you should consider accrual based accounting and defer some of this income. Again, this gets tricky.

If you’re Ebenezer Scrooge then you’re done reading. If you are paying out year-end bonuses, then keep reading. This might be a no-brainer, but make sure paychecks that are for bonuses are dated for 2024. Keep in mind too that usually in a cash-based accounting world, the check date is when the expense is recognized. As such, a pay period in December that is paid out in January is usually next year’s deduction.

Please connect with your Client Manager or favorite tax pro at WCG to review these tax planning nuggets.

Table Of Contents

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Did you want to chat about this? Do you have questions about Year-End Tax Planning? Let’s chat!

The tax advisors and business consultants at WCG are not salespeople; we are not putting lipstick on a pig expecting you to love it. Our job remains being professionally detached, giving you information and letting you decide within our ethical guidelines and your risk profiles.

We see far too many crazy schemes and half-baked ideas from attorneys and wealth managers. In some cases, they are good ideas. In most cases, all the entities, layering and mixed ownership is only the illusion of precision. As Chris Rock says, just because you can drive your car with your feet doesn’t make it a good idea. In other words, let’s not automatically convert “you can” into “you must.” Yes, it is fun to brag about how complicated your world is at cocktail parties, but let’s not unnecessarily complicate it for the bragging rights.

We typically schedule a 20-minute complimentary quick chat with one of our Partners or Senior Tax Professionals to determine if we are a good fit for each other, and how an engagement with our team looks. Tax returns only? Business advisory? Tax prep, and more importantly tax strategy and planning?

Should we need to schedule an additional consultation, our fee is $250 for 40 minutes. Fun! If we decide to press forward with a Business Advisory or Tax Patrol Services engagement, we will credit the consultation fee towards those services.

Taxes are complicated. We make them simple. Get in touch with a pro here at WCG!

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Designed for rental property owners where WCG CPAs & Advisors supports you as your real estate CPA.

Everything you need from tax return preparation for your small business to your rental to your corporation is here.

Fermentum aliquet amet

tristique purus vitae. Adipiscing

id rhoncus quisque mauris amet.