Business Advisory

Business Advisory Services

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Designed for rental property owners where WCG CPAs & Advisors supports you as your real estate CPA.

Everything you need from tax return preparation for your small business to your rental to your corporation is here.

Fermentum aliquet amet

tristique purus vitae. Adipiscing

id rhoncus quisque mauris amet.

Posted Thursday, December 5, 2024

Table Of Contents

Do you remember those days when tax professionals would charge for eFiling? Probably made sense at the time. Anyway… WCG must electronically file all tax returns. Section 6011(e)(3) of the Internal Revenue Code requires specified tax return preparers to electronically file certain federal income tax returns if they prepare more than 100 tax returns annually.

Do you remember those days when tax professionals would charge for eFiling? Probably made sense at the time. Anyway… WCG must electronically file all tax returns. Section 6011(e)(3) of the Internal Revenue Code requires specified tax return preparers to electronically file certain federal income tax returns if they prepare more than 100 tax returns annually.

Congratulations! You are almost done with all this hoopla. The IRS and most states continue to increase security in an attempt to curb identity theft. This page is divided into two categories; individual tax returns (Form 1040) and business entity tax returns (Form 1065, 1120, 1120S, 990).

Warning! If you recently sent us changes or additional information, DO NOT give us authorization to eFile until you’ve received the updated tax returns. Seriously!

There are two ways to authorize the electronic filing of your individual tax returns (Form 1040 plus the state equivalents).

As mentioned, #1 is our preference. When we send your tax returns via an email link, we also send your efile authorization documents. These are typically set up as a reminder where it will auto-send on Mondays for a few weeks. Be on the lookout for this email. Alternatively, you can log into your Canopy portal (as opposed to your Sharefile) and complete the process there.

If #2 if your preference, that is totally cool. You are not alone. This process is expanded below.

Authorize electronic filing of tax returns with our step-by-step guide and Canopy portal instructions.

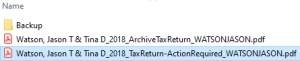

Sounds easy, right!? Of course it does. A PDF titled “Action Required” was uploaded to your client portal. Below is a snippet of Jason and Tina’s client portal highlighting the Action Required PDF. If we showed you the modified date, it would read September 9, 2019. Yeah, no self-respecting CPA files his or her own tax returns on time! Clients first! This is a 10-12 page PDF containing important instructions such as-

1. Which bank account your tax refund is going into (should you be receiving one),

1. Which bank account your tax refund is going into (should you be receiving one),

2. How to make tax payments (again, should you be required to),

3. Estimated tax payments, both individual and business if applicable,

and…

and…

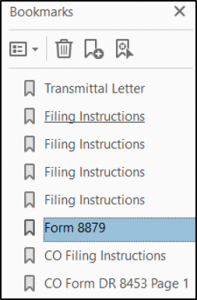

4. The eFile authorization forms to print, sign, scan and upload to your client portal. Form 8879 and its variants for business entities is the IRS authorization form. Click here to see a sample of this form. If you use Adobe as your PDF reader, you should also bookmarks to help you navigate.

To reiterate, the ActionRequired PDF is the holy grail to all that is good and true in tax. Okay, that might be a bit much… but opening that PDF and reading every page will resolve most of your questions or concerns.

The intent of the eFile authorization is give WCG permission to file your tax returns on your behalf. They are technically your tax returns, and we are simply the facilitator in the filing process. You would like to think that completing Form 8879 above would be enough, right? Oh no… states have their own version that must printed, signed and uploaded too.

Each state is different of course; California calls theirs Form 8879, just like the IRS, but Colorado calls theirs Form DR 1778 or DR 8453. Most states use 8879 which is nice. Also, you might see Form 8453; this is used when a taxpayer PIN has not been entered into the electronic record but it serves the same purpose as Form 8879.

Regardless, the state eFile authorization forms are also contained in the ubiquitous ActionRequired PDF. Have we mentioned how important this PDF is?

What about business entity tax returns? Those are eerily similar. Form 8879-S is for S Corporations (1120S), Form 8879-P is for Partnerships (1065), and Form 8879-C is for… well… yup, you guessed it, Corporations (1120).

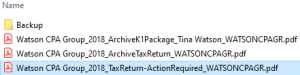

To the right is a snippet of Watson CPA Group (before our name change to WCG CPAs & Advisors). You can see a PDF titled “K1 Package” which is for our amazing shareholder, Tina, follower by the tax return itself, and then the Action Required PDF.

To the right is a snippet of Watson CPA Group (before our name change to WCG CPAs & Advisors). You can see a PDF titled “K1 Package” which is for our amazing shareholder, Tina, follower by the tax return itself, and then the Action Required PDF.

Need more help? Below is a short set of instructions similar to this, but with fancier pictures, arrows and other eye-catching colors to help you out. Sample forms are also included with signature areas highlighted.

Important! If you get confused or have questions, that is okay! Please call us at 719-387-9800 and one of our super helpful Client Support or Tax Team peeps will walk you thru it. Easy. Like Staples Easy.

Table Of Contents

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Did you want to chat about this? Do you have questions about eFile Authorization? Let’s chat!

The tax advisors and business consultants at WCG are not salespeople; we are not putting lipstick on a pig expecting you to love it. Our job remains being professionally detached, giving you information and letting you decide within our ethical guidelines and your risk profiles.

We see far too many crazy schemes and half-baked ideas from attorneys and wealth managers. In some cases, they are good ideas. In most cases, all the entities, layering and mixed ownership is only the illusion of precision. As Chris Rock says, just because you can drive your car with your feet doesn’t make it a good idea. In other words, let’s not automatically convert “you can” into “you must.” Yes, it is fun to brag about how complicated your world is at cocktail parties, but let’s not unnecessarily complicate it for the bragging rights.

We typically schedule a 20-minute complimentary quick chat with one of our Partners or Senior Tax Professionals to determine if we are a good fit for each other, and how an engagement with our team looks. Tax returns only? Business advisory? Tax prep, and more importantly tax strategy and planning?

Should we need to schedule an additional consultation, our fee is $250 for 40 minutes. Fun! If we decide to press forward with a Business Advisory or Tax Patrol Services engagement, we will credit the consultation fee towards those services.

Taxes are complicated. We make them simple. Get in touch with a pro here at WCG!

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Designed for rental property owners where WCG CPAs & Advisors supports you as your real estate CPA.

Everything you need from tax return preparation for your small business to your rental to your corporation is here.

Fermentum aliquet amet

tristique purus vitae. Adipiscing

id rhoncus quisque mauris amet.