Business Advisory

Business Advisory Services

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Designed for rental property owners where WCG CPAs & Advisors supports you as your real estate CPA.

Everything you need from tax return preparation for your small business to your rental to your corporation is here.

Fermentum aliquet amet

tristique purus vitae. Adipiscing

id rhoncus quisque mauris amet.

Posted Friday, October 18, 2024

Table Of Contents

We encourage businesses to implement an Accountable Plan which allows employee owners to turn in expense reports for the business use of personal assets. We’ll run through some common ones in a bit.

We encourage businesses to implement an Accountable Plan which allows employee owners to turn in expense reports for the business use of personal assets. We’ll run through some common ones in a bit.

What’s the big deal? The big deal is that the IRS considers any reimbursement to be taxable income unless a proper Accountable Plan is adopted and implemented. This problem isn’t terrible since you could also deduct employee business expenses on Form 2106 which was later a Schedule A itemized deduction. So, the reimbursement is deducted by the business, later considered taxable income to you but netted to zero once you deducted the same expenses on Form 2106. The deduction only truly happened on the business tax return.

However, the days of deducting these employee business expenses on Form 2106 are gone after the Tax Cuts and Jobs Act of 2017. As such, an Accountable Plan is needed now more than ever. An Accountable Plan is easy to do, is a great way to pull money out of the business, and actually reduces the amount of taxes paid. A win-win scenario.

When discussing Accountable Plan stuff, there are three general expense types.

The expenses that are 100% business such as copy paper, business meals, advertising, etc. should be paid by the business directly. Sure, we leave room for the business owners who want to rack up miles on their personal credit card. This is bad for a handful of reasons; a) it makes record keeping a chore, b) it co-mingles money which the IRS cannot stand and c) it breaks down the arms-length perspective between you and your business which plaintiffs love when suing you. We know business owners who have two credit cards, and they are both linked to their United MileagePlus account (as an example); one for business in the business name, and the other for personal.

The expenses that are 100% personal such as gym memberships, haircuts, your HBO subscription, etc. should be paid by you, the person, and not you, the business owner. Yes, we all accidentally whip out the business credit card at the grocery store. And, at times, the business owner will use whatever checking account has the most money in it. Don’t do it! Fire up your phone, move the money to your personal checking account as a distribution, and pay for those movie tickets yourself.

Mixed use expenses must always be paid personally, and then reimbursed by the business on a pro-rated or business-use percentage. Think of yourself working for Google, and they ask you to be on call during the weekends and drive your car to pick up pencils; Google wouldn’t pay for your cell phone or car directly, but they would reimburse you for the portion of your miles and cell phone that are considered Google-related.

Therefore, only business expenses that you paid for personally should be listed on the Accountable Plan Worksheet and Reimbursement form. This distinction has proven to be problematic in the past. Contact us with questions.

We’ll talk about the big four expenses next!

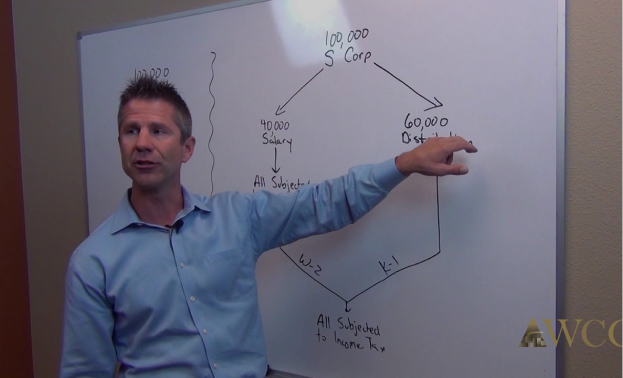

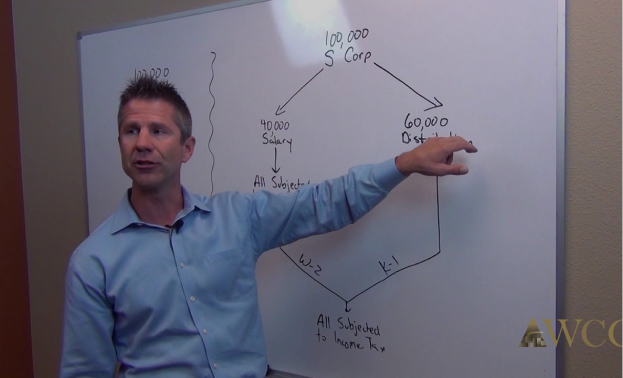

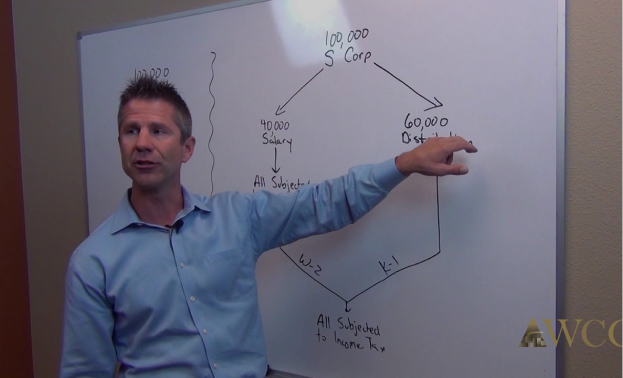

This video stars Latesha Anderson of our Business Development team. She outlines the process of creating an entity and having it taxed as an S corporation. She also outlines the late S corp election process.

This video stars Latesha Anderson of our Business Development team. She outlines the process of creating an entity and having it taxed as an S corporation. She also outlines the late S corp election process.

This video stars Latesha Anderson of our Business Development team. She outlines the process of creating an entity and having it taxed as an S corporation. She also outlines the late S corp election process.

When discussing the primary mixed use (personal and business), these are the four most common.

The home office reimbursement is commonly done using square footage. Your house is 2,500 square feet, your office is a 12 x 12 room and as such represents 5.8% (144 / 2,500) of your home. This percentage is then applied to your mortgage interest and property taxes (or monthly rent should you rent), utilities, maintenance, repairs, etc. becomes an Accountable Plan reimbursement. We have written several articles on home offices that discuss the 50-mile rule, depreciation, safe harbor and some other interesting tidbits. Check them out here:

Learn about tax home implications and why forming a business in another state isn’t a loophole.

Discover practical strategies for tax reduction/avoidance and how this ties to a home office.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod teconsectetur adipiscing elit, sed mpor.

Many business owners use their cell phone for business, but they also try to deduct 100% of the cell phone expenses as a business expense. This is a challenge if you only have one cell phone; the day you get a text from your spouse asking for milk and eggs on the way home from work, your cell phone is suddenly something less than 100%. The business use percentage frankly is a SWAG. The days of recording each phone call are luckily gone, but you still need to demonstrate why you chose 75% business use over 40% (for example). The key here is to be reasonable! You will get way more leniency with a number that appears reasonable.

Straightforward since it is handled similarly to your cell phone.

If you own your automobile personally but use it for your business, then you should reimburse yourself for the business use of the automobile. You can either do this using a mileage rate or a percentage of actual expenses. Most automobiles and light duty trucks will operate for much less than the mileage rate, and as such there is some tax arbitrage between your actual costs and the amount deducted on the business tax return as a reimbursement. Should you own your automobile as a business asset? We have written some great articles on this topic too!

The button below takes you to the Accountable Plan chapter in our book, Taxpayer’s Comprehensive Guide to LLCs and S Corps. It is a much deeper dive than what we explained here. We also have a video on this stuff if you cannot get enough.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod teconsectetur adipiscing elit, sed mpor.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod teconsectetur adipiscing elit, sed mpor.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod teconsectetur adipiscing elit, sed mpor.

We designed a fancy MS Excel spreadsheet where you can enter your mixed use expenses. We suggest detailing your expenses and reimburse yourself through your Accountable Plan once every quarter- it is good accounting to stay on top of this, and memories tend to fade. More importantly, it helps with tax planning.

We designed a fancy MS Excel spreadsheet where you can enter your mixed use expenses. We suggest detailing your expenses and reimburse yourself through your Accountable Plan once every quarter- it is good accounting to stay on top of this, and memories tend to fade. More importantly, it helps with tax planning.

It is unfortunately too common when a business owner tells us he or she is making $100,000 after expenses throughout the year, and then during tax preparation he or she tells us about a $20,000 Accountable Plan reimbursement. It creates a big refund, sure, but it is not good tax planning.

Like any spreadsheet, it is only meaningful to the spreadsheet designer. So, we’ve created directions on using our Accountable Plan Worksheet and Reimbursement template. If you hate it, please kindly let us know. If you like it, simply send donuts and we’ll receive the message. Pictures of donuts don’t count.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod teconsectetur adipiscing elit, sed mpor.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod teconsectetur adipiscing elit, sed mpor.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod teconsectetur adipiscing elit, sed mpor.

The Accountable Plan Template spreadsheet is now combined with our Income Statement template which is used primarily for gathering up your year-end tax information. We call this our Simplified Biz Ops worksheet or SBO for short. Check it out!

The most elegant way, and the way we and the IRS prefer, is that you write a check or a do a transfer from your business checking account to your personal checking account in the amount of the reimbursement. Think of you and your business as separate entities, since they truly are. If you worked for another business that you didn’t own, the business would write you a check for the amount of expenses you covered personally. Same thing here.

Another less elegant way is to re-classify owner or shareholder distributions as employee reimbursements. For example, let’s say you took out $20,000 over the quarter as distributions. But after completing the Accountable Plan Worksheet and Reimbursement form, the company owed you $5,000. We would make an entry to reflect the reimbursement, and your shareholder distributions would be re-classified as a $15,000 distribution and a $5,000 reimbursement. The reimbursement becomes a business expense and deduction, and is non-taxable to you.

Our KB article has a great example including journal entries of how this works and our Accountable Plan instructions do as well.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt it amet, conse ctetur adip iscing elit, sed do eiusmod tempor incididunt ut.

If you do not have an Accountable Plan and associated Corporate Meeting Minutes / Adoption, please let us know. We can draft the documents and provide consultation to answer questions for $250.

Accountable Plan Reimbursement forms must be retained along with the proper record keeping such as receipts, invoices, credit card statements, etc. including a record or log (such QuickBooks or Excel).

Table Of Contents

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Did you want to chat about this? Do you have questions about Accountable Plan? Let’s chat!

The tax advisors and business consultants at WCG are not salespeople; we are not putting lipstick on a pig expecting you to love it. Our job remains being professionally detached, giving you information and letting you decide within our ethical guidelines and your risk profiles.

We see far too many crazy schemes and half-baked ideas from attorneys and wealth managers. In some cases, they are good ideas. In most cases, all the entities, layering and mixed ownership is only the illusion of precision. As Chris Rock says, just because you can drive your car with your feet doesn’t make it a good idea. In other words, let’s not automatically convert “you can” into “you must.” Yes, it is fun to brag about how complicated your world is at cocktail parties, but let’s not unnecessarily complicate it for the bragging rights.

We typically schedule a 20-minute complimentary quick chat with one of our Partners or Senior Tax Professionals to determine if we are a good fit for each other, and how an engagement with our team looks. Tax returns only? Business advisory? Tax prep, and more importantly tax strategy and planning?

Should we need to schedule an additional consultation, our fee is $250 for 40 minutes. Fun! If we decide to press forward with a Business Advisory or Tax Patrol Services engagement, we will credit the consultation fee towards those services.

Taxes are complicated. We make them simple. Get in touch with a pro here at WCG!

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Designed for rental property owners where WCG CPAs & Advisors supports you as your real estate CPA.

Everything you need from tax return preparation for your small business to your rental to your corporation is here.

Fermentum aliquet amet

tristique purus vitae. Adipiscing

id rhoncus quisque mauris amet.