Business Advisory

Business Advisory Services

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Designed for rental property owners where WCG CPAs & Advisors supports you as your real estate CPA.

Everything you need from tax return preparation for your small business to your rental to your corporation is here.

Fermentum aliquet amet

tristique purus vitae. Adipiscing

id rhoncus quisque mauris amet.

Posted Monday, December 2, 2024

Table Of Contents

When doing business either online or face-to-face, you want peace of mind that things will go smoothly. Furthermore, if things don’t go as planned, then you want comfort in knowing they will be taken care of. WCG takes customer service and satisfaction very seriously.

When doing business either online or face-to-face, you want peace of mind that things will go smoothly. Furthermore, if things don’t go as planned, then you want comfort in knowing they will be taken care of. WCG takes customer service and satisfaction very seriously.

We regret that we’ve upset clients in the past. We wholly admit that we’ve made mistakes, and because we are human we will be prone to future mistakes. Everyone at WCG takes client dissatisfaction as a personal failure, not just a company failure.

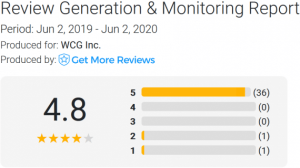

Yes, we use a reputation monitoring service (Get More Reviews) and Sure we could hire an agency to stuff the ballot box so-to-speak and puff up our Google, Facebook and Yelp reviews. But that’s not the right approach and certainly not our style. Our reviews, good or bad, are from real people, making real comments about real things.

So, what to make of all this? Two things- First, WCG stands by its work product. If we screw something up, we will make it right. No excuses. No “yeah, buts.” From there, we typically look at the procedure; do we need an adjustment? Was this a “one-off?” Is there confusion among our staff about this particular process? These are all questions that we openly discuss and answer. Our intent is to do a better job tomorrow than we did today.

Second, as Murphy’s Law states, “People don’t make the same mistake twice. They make it three, four, five times.” All kidding aside, we are constantly learning and continuously improving. We have developed checklists and procedures to minimize mistakes, and to aim for a high quality client interaction. As Vince Lombardi once said, “Perfection is not attainable. But if we chase perfection, we can catch excellence.” Sure, we’re Packer fans so Lombardi is always at the top of our minds… it helps us do a better job tomorrow than we did today.

Additionally, if we created a penalty for you, we will pay it. We’ve also refunded our fees at times when appropriate. At any rate, our goal is make things right and to earn your trust in the future.

In our breakroom we have a magnetic dry-erase board where we post clients’ comments on how wonderful we are. Since the accounting business is generally negative, we want to show our staff how their efforts are appreciated. When we receive criticism from our clients, we usually use it as a coaching moment during our weekly manager meetings since plastering negativity without discussions and coaching doesn’t help anyone.

In our breakroom we have a magnetic dry-erase board where we post clients’ comments on how wonderful we are. Since the accounting business is generally negative, we want to show our staff how their efforts are appreciated. When we receive criticism from our clients, we usually use it as a coaching moment during our weekly manager meetings since plastering negativity without discussions and coaching doesn’t help anyone.

What is also pretty cool… at least we think it is… every two weeks we have an All Hands meeting. At the end we have Latesha, who is our Brand Ambassador, read off online reviews and survey results. Jason reads Employee RAVEs which are submissions by employees in reference to other employees doing amazing things. We try to end our meetings on a bit of positivity.

We often get asked, “Can you send me a few of your current clients as references?” The answer is, “Sure, but we need to ask for explicit permission first.” Current privacy laws and our professional standards as promulgated by the American Institute of Certified Public Accountants (AICPA) prohibit us from disclosing our clients’ identities without permission. Therefore, we can certainly provide references but it takes some effort.

Also understand that we are only going to provide references of clients who absolutely adore us and who would lay down in traffic for us. This is no different than your last employer who asked for references- you only gave them the ones that you had excellent relationships with. This is probably one of the reasons that references are becoming a bit out-dated.

Having said that, we put together two videos from 2020 with client testimonials. Check them out!

Reviews from our clients who have used WCG for their business, accounting and tax planning.

Since our client interactions are about relationships, WCG has a short list of expectations from our clients. We do not believe in the adage that the customer is always right. Sorry. This might seem harsh, but we have several good clients who are paying us to keep bad clients out of the fortress so we may leverage our resources correctly.

We expect clients to have a sense of urgency. As Tina Watson, founder of WCG, says, “We hope you value your business as much as we value your business.” In other words, we need clients to carve out time for us so we may do the job you’ve hired us to do. It doesn’t make any sense to hire a housekeeper but not provide access to the house.

Our relationship isn’t a drive-thru transaction. We want to work together on understanding your business, tax and financial worlds. Sure, we have several clients who provide beautiful financial statements and we produce equally beautiful tax returns. At the same time, we prefer to review the financial statements, poke around a bit, ask some questions and collaborate with you to ensure the best advice is being offered and the best tax return is being prepared.

We want you to be open and honest with us. We don’t like playing hide the ball or some silly guessing game. Accountants unfortunately do not have the same client privileges as attorneys, doctors and clergy enjoy. However, we’d rather have you tell us the truth in plain language so there is no confusion.

We are not machines. We are human beings who from time to time make mistakes and have bad days. While one of our favorite phrases is “We are all actors on a stage. We do not have bad days.” we expect the same compassion from you that we offer to you. The Golden Rule comes to mind. We do not tolerate swearing or yelling at our staff. Jason Watson remembers working for the airlines when passengers would be screaming at the gate agent, and he would simply say, “if your gate agent could say anything other than your flight is cancelled she would, but she can’t, so cut her some slack.”

To become a CPA you need 150 credits of school (which means a Master’s Degree), to pass a ridiculously tough four-part test (45% passage rate) and work for another CPA for 2,000 hours. A lot of clients want to understand how things work. This is great, and we love teaching the basics. We truly do. However, please understand that a newbie CPA spent 6-7 years just to become a CPA and it is difficult to reduce all that knowledge into a singular conversation. We hope that our clients can get to a point where they trust the professionals they hire, and they verify the work product.

Taxes are a way of life. We are not interested in doing business with clients who do not believe in paying taxes or who do not have the fiscal responsibility to pay taxes. Yes, we want to minimize taxes. No kidding. It is your duty as an American citizen to pay the least amount of taxes allowed by law, and we will help you do that. At the same time, Franklin D. Roosevelt said in 1936, “Taxes, after all, are the dues that we pay for the privileges of membership in an organized society.”

Of the G20 countries, only South Korea, India, Mexico, Turkey, Canada, Indonesia, Brazil and Russia have lower personal income tax rates. None of those countries with the possible exceptions of South Korea and Canada sound like a place worth living in (in our humble opinion). We live in a great country. Pay your dues. Just not a penny more.

We are tax and business consultants, not just number crunchers. Anyone can balance a checkbook. Anyone can put the right number in the right blank. But we take a consultative approach to tax preparation. You can always find someone to do it for less – of course. However consider the solid back-end support which you will get with WCG that other tax preparation companies might not provide. Read more about our Value Proposition here.

Table Of Contents

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Did you want to chat about this? Do you have questions about WCG Reviews? Let’s chat!

The tax advisors and business consultants at WCG are not salespeople; we are not putting lipstick on a pig expecting you to love it. Our job remains being professionally detached, giving you information and letting you decide within our ethical guidelines and your risk profiles.

We see far too many crazy schemes and half-baked ideas from attorneys and wealth managers. In some cases, they are good ideas. In most cases, all the entities, layering and mixed ownership is only the illusion of precision. As Chris Rock says, just because you can drive your car with your feet doesn’t make it a good idea. In other words, let’s not automatically convert “you can” into “you must.” Yes, it is fun to brag about how complicated your world is at cocktail parties, but let’s not unnecessarily complicate it for the bragging rights.

We typically schedule a 20-minute complimentary quick chat with one of our Partners or Senior Tax Professionals to determine if we are a good fit for each other, and how an engagement with our team looks. Tax returns only? Business advisory? Tax prep, and more importantly tax strategy and planning?

Should we need to schedule an additional consultation, our fee is $250 for 40 minutes. Fun! If we decide to press forward with a Business Advisory or Tax Patrol Services engagement, we will credit the consultation fee towards those services.

Taxes are complicated. We make them simple. Get in touch with a pro here at WCG!

Everything you need to help you launch your new business entity from business entity selection to multiple-entity business structures.

Designed for rental property owners where WCG CPAs & Advisors supports you as your real estate CPA.

Everything you need from tax return preparation for your small business to your rental to your corporation is here.

Fermentum aliquet amet

tristique purus vitae. Adipiscing

id rhoncus quisque mauris amet.